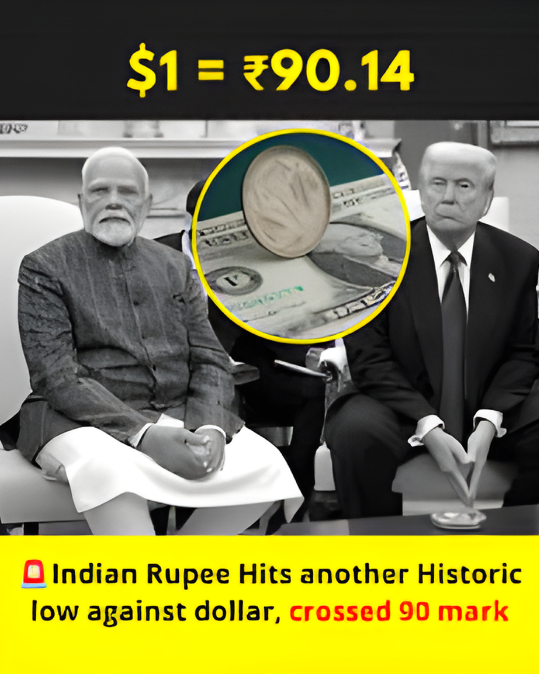

The Indian rupee slipped to a new all-time low of 91.01 against the US dollar on Tuesday, pressured by uncertainty over the India–US trade deal, continued foreign investor selling, and a cautious global market mood.

During the day, the rupee weakened further to an intra-day low of 91.14, marking a fall of 36 paise from the previous close. Although it recovered slightly by the end of the session, the currency still closed 23 paise lower. This slide came despite a sharp drop in global crude oil prices, which usually offers some support to the rupee.

What’s Driving the Fall?

Government officials said developments linked to the India–US trade negotiations have weighed heavily on the currency. In Parliament, the government acknowledged that while a weaker rupee increases import costs, it could also help make Indian exports more competitive globally.

Over the past 10 trading sessions, the rupee has slipped from the 90-per-dollar level to 91. In just the last five sessions, it has fallen by around 1%, reflecting growing pressure from both global and domestic factors.

Government View: Depreciation Can Help Exports

According to Minister of State for Finance Pankaj Chaudhary, the rupee’s depreciation this financial year has been driven by a widening trade deficit and uncertainty surrounding trade talks with the US, along with limited support from capital inflows.

He added that while a weaker currency can support exports, its impact on inflation depends on how much higher global prices are passed on to domestic markets.

Recent trade data shows some positive signs. India’s exports jumped nearly 19.4% in November to a six-month high of $38.13 billion, led by engineering and electronics goods. Imports declined due to lower purchases of gold, crude oil, coal, and coke, helping narrow the trade deficit to a five-month low of $24.53 billion.

Not Everyone Is Convinced

Some experts remain sceptical about the long-term benefits of a weaker rupee. Ajay Srivastava of think tank GTRI pointed out that despite the rupee losing nearly half its value since 2013, export growth has remained modest. He cited issues such as high input tariffs, strict quality norms, supply-chain challenges, and dependence on imported components as key obstacles.

What’s Next for the Rupee?

Market participants warn that the currency could weaken further. Anindya Banerjee of Kotak Securities said continued uncertainty around global trade tensions, nearly $2.7 billion in FPI outflows so far this month, and rising US bond yields could push the rupee closer to the 92 level.

He added that the RBI’s relatively restrained intervention appears intentional. Meanwhile, Axis Bank’s Neelkanth Mishra expects the rupee to see a gradual, controlled decline rather than a sharp fall, noting that heavy intervention last year drained foreign exchange reserves and pushed the currency beyond the 90 mark.

For now, the rupee remains under pressure, with investors closely watching global trade developments and capital flows for the next cue.